Living on a prayer

Sorry boys and girls, but in comparison to recent postings on the blog, I will be remarking on a subject which is a nasty bump back down to reality and not as much fun as the general custom of having a laugh and posting complete crap about how great you are on Facebook.

By some messed up measure of economic power within the UK, I technically come into the top 20% of earners which even being down in London is a remarkable achievement. But it’s also remarkable how far that doesn’t go, and it’s worse if you have a family too in tow along with an expensive drug habit. Maybe….err….

Since various massive expenses have come into play, mainly as a result of moving into a new place, the phrase “living paycheck to paycheck” has never really been more utmost in my mind and it becomes disheartening to see that the minus sign next to the bank balance never goes away.

One day, we will all dream to earn this much…

There are big expenses upcoming which in essence will ensure that minus sign remains permanently fixed next to any amount listed for some time to come. Loans taken, need to be paid back. Credit cards charge interest if you leave amounts on them for too long.

In essence, it’s all the makings of the same story you’ve heard time and time again from people that in worse positions end up in.

Given the fact that the cost of living will continue to increase (save at a lower rate in the new year till after the general election when they add on much more) and the wages remaining at a finite level, it makes far more sense to actually readjust the outgoings to ensure a better balance and not feel as bad at the end of the month.

Easier said than done.

It involves a change in behaviour which more often than not is hard to accept as it involves having to be “sensible.” Egh, sensible. Such a horrible thing to say. Like saying you enjoy picking away at your nose hairs.

The new hip place to be.

But every once in a while, the fast merry-go-round of behaving like a monkey with attention deficit disorder has to slow down for a little while.

Just for a little bit, so you get yourself together. But how best to do that without pulling back so far that you end up miserable and feeling annoyed about the situation all the more? Who hasn’t had the laudable goal of sticking at something, only to get distracted by dangling shiny keys and end up back at the same point as before?

You may spend more time looking for the bargains in Poundland more than Waitrose, because it makes more sense. You can make all the jokes you want (I still wish they had a black friday sale too) and lament the questionable business practices of using free labour from the jobcentre, but sorry, 6 packs for the price of 4 for low fat crisps for £1, it takes priority.

Making your own lunch is not the stuff dreams are made of. Well, not unless they are made with bread with helpings of coleslaw.

Aside from the odd leftovers from the night before, you basically make the same thing day in day out to stretch out the hard earned pound out but there is no reason why making sandwiches and taking some fruit can’t get you through the day just as much as eating out at the fancy lunch place where soup costs the weekly gross domestic product of Belgium.

Again, it makes a big difference to the monthly budget. It may also not do much for your hips and pregnant belly for bathing suit season though but that is where our next contestant comes in.

The gym is the church of broken self promises. January comes, with it, the sentiment of the new year and new ideas about being better and then shortly you begin to see who sticks it out after 2 months. It also doesn’t come cheap, especially in London, where some of them charge £80 a month + for the fun of still being able to fit into the same clothes.

That also was one of the first things to be cut back on, but not cut off, you’ve still got to keep some form of health going even if you despise the whole affair. Various smaller startups offer the same level of equipment but for far less. Cut the bill from £67 to £25 a month and you can not go to the gym just as much on less.

Act now and receive free air to breathe.

All those nights of drinking heavily and vomiting before making the pain go away with the plink-plink-fizz? Best not to. But hang on, why would you have to stay in all the time? There are various things about town where you wander to, see different things you wouldn’t do normally and sometimes they surprise you. How else could I explain the night of being in the cinema, watching Seinfeld for the first time while enjoying some beer and soup?

Speaking of watching old TV, there are some excellent ways to continue enjoying the gogglebox slouching while scratching yourself and muttering yep. Recently, a ridiculous number of points from one of the many many rewards cards which help to track our every move within various supermarkets, a £15 blu-ray was had for £2.49 instead.

Some second hand goods are more than good enough and they still achieve the same thing you were after. It’s actually a decent way to ensure your money goes further as well. That said sometimes, new is better in case the previous owner has had their wicked way with it. It’s a balancing act depending on the purchase, but overall, most of the time for media, you’re going to be fine.

And now we play the waiting game…..

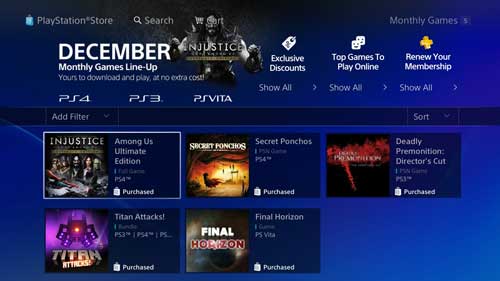

For those of us who prefer to stay away from the outside world and game the life away, remarkably that also has been a cost saving exercise that has gone very well. EA gave away some games as part of the 20th Sony Playstation anniversary, which again will provide fun times when it’s cold outside. Perhaps it’s about time that we sit down and go through that ridiculous backlog that’s built up over the years? The rest of the new good stuff will be there when you’re finished.

If changes like the above mean that you can have something simple such as hot water and heating all the time when you need it, what choice would you make? It’s worth it in the long run. Probably. Ish.

Are you a politician?

You sound like one!

Vote Leisure!